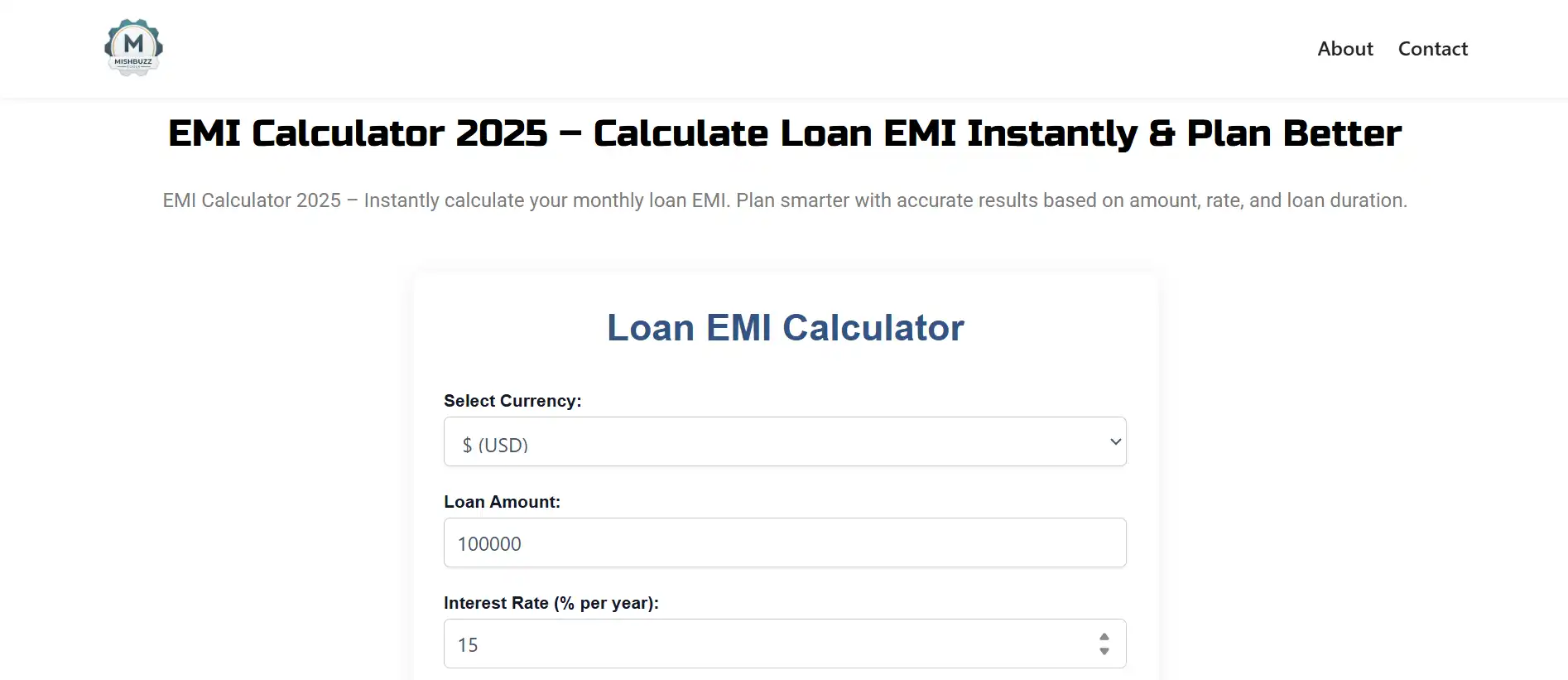

EMI Calculator 2025 – Calculate Loan EMI Instantly & Plan Better

EMI Calculator 2025 – Instantly calculate your monthly loan EMI. Plan smarter with accurate results based on amount, rate, and loan duration.

Accurate Loan EMI Calculator - Plan Your Monthly Payments with Confidence

A Loan EMI Calculator is an essential financial planning tool for anyone considering personal loans, home mortgages, car financing, or business credit. Our advanced calculator provides precise monthly payment estimates, helping you make informed borrowing decisions and maintain financial stability.

Key Benefits: Plan your budget • Compare loan offers • Understand interest costs • Avoid financial stress

Understanding EMIs: The Foundation of Loan Repayment

EMI (Equated Monthly Installment) is the fixed payment amount a borrower makes each month toward loan repayment. This payment consists of two components:

Principal Component

The portion that reduces your actual loan amount. This increases gradually over the loan tenure.

Interest Component

The cost of borrowing charged by lenders. This decreases as your principal reduces.

How Our EMI Calculator Works: Precision Finance Mathematics

Our calculator uses the industry-standard formula adopted by banks globally:

EMI = [P × R × (1+R)^N] / [(1+R)^N - 1]

| Variable | Description | Example |

|---|---|---|

| P | Loan Principal Amount | ₹5,00,000 |

| R | Monthly Interest Rate (Annual Rate ÷ 12 ÷ 100) | 10% annual = 0.00833 monthly |

| N | Loan Tenure in Months | 60 months (5 years) |

EMI Impact Analysis: How Variables Affect Your Payments

| Loan Amount | Interest Rate | Tenure | Monthly EMI | Total Interest |

|---|---|---|---|---|

| ₹5,00,000 | 8% | 5 years | ₹10,136 | ₹1,08,160 |

| ₹5,00,000 | 10% | 5 years | ₹10,624 | ₹1,37,440 |

| ₹5,00,000 | 10% | 7 years | ₹8,305 | ₹1,97,620 |

Strategic EMI Reduction Techniques

⏳ Extend Loan Tenure

Increasing repayment period from 5 to 7 years can reduce EMI by 20-25%

💰 Negotiate Better Rates

A 0.5% rate reduction on ₹10 lakh loan saves ₹30,000+ in interest

📥 Increase Down Payment

20% down payment instead of 10% reduces EMI burden by 15-18%

Amortization Schedule: Understanding Your Payment Breakdown

An amortization schedule shows how each payment is split between principal and interest over the loan term:

| Year | Principal Paid | Interest Paid | Balance |

|---|---|---|---|

| 1 | ₹78,400 | ₹49,200 | ₹4,21,600 |

| 2 | ₹86,300 | ₹41,300 | ₹3,35,300 |

| 3 | ₹95,100 | ₹32,500 | ₹2,40,200 |

| 4 | ₹1,04,700 | ₹22,900 | ₹1,35,500 |

| 5 | ₹1,15,500 | ₹12,100 | ₹0 |

Essential Financial Resources

Internal Tools

Frequently Asked Questions

How does EMI differ for floating vs fixed rates?

Fixed-rate EMIs remain constant throughout the loan tenure. Floating-rate EMIs change with market conditions - they may decrease during rate cuts but increase when rates rise.

What's the ideal EMI-to-income ratio?

Financial experts recommend keeping EMIs below 40% of your monthly income. For example, with ₹50,000 monthly income, your total EMIs should not exceed ₹20,000.

How do prepayments affect EMIs?

Prepayments reduce your principal balance, which can either: 1) Reduce your EMI amount while keeping tenure same, or 2) Reduce your tenure while keeping EMI same.

Plan Your Financial Future Today

Use our EMI calculator to make informed borrowing decisions. Avoid financial stress and create a repayment plan that fits your budget comfortably.

Try it now and take control of your finances!